Let’s take them in reverse order…

5. Altair to acquire Metrics Design Automation

At DAC 2024, Altair showcased its 3D-IC design and SimLab multi-physics modelling and simulation tool. The company has also announced the acquisition of Metrics Design Automation, a Canadian company led by Joe Costello , former CEO of Cadence Design Systems (1988-1997). The company described DSim as a full feature System Verilog and VHDL RTL simulator. It enables designers to simulate the engineering behaviour of complex assemblies.

4. Clock detects effects of gravity predicted by Einstein’s theory of relativity

Researchers at JILA, a joint institution of the US National Institute of Standards and Technology (NIST) and the University of Colorado Boulder, have developed an atomic clock that can detect the effects of gravity predicted by the theory of general relativity at the microscopic scale. The clock is the latest demonstration that a much more precise definition of the official second is possible and that new applications of clocks are feasible.

3. Auto semiconductors by segment

By 2027, the automotive semiconductor market will see significant growth for logic, memory, microprocessors, analogue, opto, discretes and sensors, says IDC. Auto memory revenue will top $7 billion by 2027 to accommodate larger volumes of source code, map data, media content, and log information while high-speed interface technologies such as PCIe and UFS facilitates real-time data processing and instantaneous feedback. Auto microprocessors are anticipated to have revenue of over $15 billion by 2027.

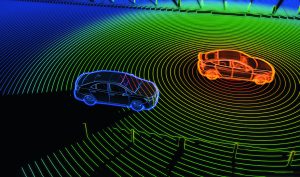

2. LiDAR market on 38% CAGR 2023-29

The global LiDAR market for automotive is expected to grow from $538 million in 2023 to $3,632 million in 2029 at a 38% CAGR 23-29, says Yole Group. Chinese OEMs are pushing for the integration of LiDAR in their vehicles. In 2024, Hesai and RoboSense are expected to continue leading the passenger car LiDAR market. LiDAR manufacturers are now producing higher volumes and new technologies, which should reduce the cost of LiDAR.

1. Intel drops to No.3

1. Intel drops to No.3

In Q1 2024, Samsung regained the No.1-spot in the global semiconductor market, with strong demand from the memory market, especially for DDR5 and HBM, says Counterpoint Research. NVIDIA ranked No.2 with 19% QoQ revenue growth, thanks to its dominance in AI. Intel reported a 14% QoQ revenue decline in Q1 2024 due to soft demand at Intel foundry, Altera and Mobileye. Hynix and Micron benefited from the solid memory market to report sequential revenue growth and rank No.4 and No.7 respectively during the quarter.